Is the Fed Following a “Modernized” Version of the Taylor Rule? Part 2

Given these developments, Bullard proposes an alternative, what he terms a “modernized” version, of the Taylor rule:

it = ρit–1 + (1 – ρ)(rt* + π* + ϕππtGAP + ϕuutGAP).

Bullard’s modernized version of the Taylor rule embeds several changes from Taylor’s original specification.4 First, there is a one-quarter lag of the federal funds target rate (it–1) with a fixed coefficient of ρ. This “smoothing” parameter is used by many in the policy rule literature. In this case, Bullard assigns ρ a value of 0.85. This assignment means that the past period’s policy rate is extraordinarily important for setting the current period’s policy rate. Second, the output and inflation gaps remain in the policy function, but they are measured a bit differently. The output gap (utGAP) is instead measured as the difference between the current unemployment rate and the Congressional Budget Office’s natural rate of unemployment. The inflation gap (πtGAP) is measured as the difference between a market-based measure of inflation expectations and the Fed’s inflation target. Specifically, inflation expectations are measured as the difference between the nominal yield on a 5-year (5Y) Treasury security and the yield on an inflation-adjusted (real) 5Y Treasury inflation-protected security (TIPS).5 This difference is sometimes called the breakeven inflation (BEI) rate. Third, rt* now varies over time instead of being set at a fixed 2 percent. In this case, rt* is measured as the trend interest rate estimated from a Hodrick-Prescott filter of the 1-year nominal constant maturity Treasury yield less the four-quarter change in the Federal Reserve Bank of Dallas’s trimmed mean measure of the personal consumption expenditures (PCE) inflation rate. Fourth, the current inflation rate, πt, is replaced by the Federal Open Market Committee’s (FOMC’s) inflation target (π*), which is set at 2 percent. Finally, Bullard reduces the coefficient on the unemployment rate gap (ϕu) to 0.1, to reflect the flatness of the Phillips curve. The coefficient on the inflation gap (ϕπ) is equal to 1.5 and consistent with the 1993 Taylor rule. Since ρ equals 0.85, this value means that the rule is very inertial in setting policy—that is, the past period’s federal funds target rate is important for setting the current period’s target rate.

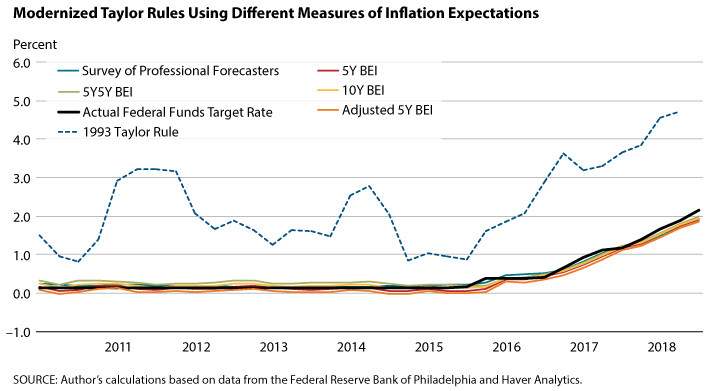

The figure plots five versions of Bullard’s modernized Taylor rule that are based on five different measures of inflation expectations. Four of the five measures of inflation expectations are market-based measures calculated as the difference between the yield on a nominal Treasury security and the yield on a TIPS. The first market-based measure is Bullard’s preferred measure: the 5Y BEI less 30 basis points (the adjusted 5Y BEI). The second is the market’s predicted average inflation rate over the next five years without this adjustment: the 5Y BEI. The third market-based measure is the inflation rate that is expected to prevail over the five-year period beginning five years from today: the 5Y, 5Y forward BEI (5Y5Y BEI). The fourth market-based measure is the average inflation rate that is expected to prevail over the next 10 years: the 10Y BEI. The final inflation expectations measure is based on the Federal Reserve Bank of Philadelphia’s quarterly Survey of Professional Forecasters. Specifically, each participant in the survey is asked to forecast the average PCE price index inflation rate expected over the next 10 years.6

The figure also plots the federal funds rate calculated from the 1993 Taylor rule, as described above and plotted in Part 1 of this Economic Synopses essay. To see how these two rules differ in their policy prescriptions, consider the prescription for the fourth quarter of 2015, when the FOMC lifted its federal funds target rate for the first time in a decade. The 1993 Taylor rule indicated that the rate should be set at 0.88 percent. The average of the five rules cited above was 0.12 percent, which was pretty close to the actual average of 0.16 percent. Over the next four quarters, real GDP growth remained close to 2 percent, the unemployment rate fell from 5 percent to 4.7 percent, and inflation increased from 1.6 percent to 2 percent. In the fourth quarter of 2016, the 1993 Taylor rule indicated that the target rate should be 2.9 percent, while the average of the five modernized Taylor rules was 0.46 percent. The actual target rate in the fourth quarter of 2016 was 0.42 percent. A key difference between the two rules during this period is that the 1993 Taylor rule assumes a fixed r* equal to 2 percent. In the modernized rule, rt* was equal to –1.12 percent in the fourth quarter of 2015 and then –0.72 percent four quarters later.

Visual evidence from the figure suggests that the FOMC has been—more or less—following Bullard’s version of the Taylor rule during this expansion rather than the 1993 Taylor rule. With most measures of inflation expectations converging to around 2 percent in the fourth quarter of 2018, the recommended FOMC interest rate targets from the modernized Taylor rules have effectively converged to slightly less than 2 percent: From 1.84 percent using the adjusted 5Y BEI measure of inflation expectations to 1.99 percent using the 5Y5Y BEI measure of inflation expectations. On balance, then, using available 2018 fourth-quarter values, this framework suggests policy is modestly “tight” based on the current federal funds target range of 2.25 percent to 2.5 percent.7

If inflation expectations remain anchored at close to 2 percent and the unemployment rate remains close to its current level or even falls a bit further, then the rule stipulates that the only reason to raise rates would be if rt*increases.

Notes

1 Kliesen (2019).

2 See Bullard (2017).

3 See Powell (2018).

4 See Bullard (2018).

5 The Treasury uses the consumer price index to adjust the nominal price of the TIPS. Bullard subtracts 30 basis points from the 5Y BEI, arguing this better accounts for the upward bias of the consumer price index relative to inflation measured by the PCE inflation rate.

6 The inflation expectations measure is the median response.

7 The rules in the figure for the fourth quarter of 2018 use the average of daily observations for inflation expectations and the federal funds target rate. The latter includes the 25-basis-point increase in the federal funds target range on December 19, 2018.

References

Bullard, James. “The St. Louis Fed’s New Characterization of the Outlook for the U.S. Economy.” Federal Reserve Bank of St. Louis, June 17, 2017; https://www.stlouisfed.org/~/media/files/pdfs/bullard/papers/regime-switching-forecasts-17june2016.pdf?la=en.

Bullard, James. “Modernizing Monetary Policy Rules.” Presentation to the Economic Club of Memphis, Memphis, TN, October 18, 2018; https://www.stlouisfed.org/~/media/files/pdfs/bullard/remarks/2018/bullard_memphis_economic_club_18_october_2018.pdf?la=en.

Kliesen, Kevin. “Is the Fed Following a ‘Modernized’ Version of the Taylor Rule? Part 1.” Federal Reserve Bank of St. Louis Economic Synopses, January 2019, No. 2; https://research.stlouisfed.or….

Powell, Jerome H. “Monetary Policy and Risk Management at a Time of Low Inflation and Low Unemployment.” Remarks to the 60th Annual NABE Meeting, Boston, MA, October 2, 2018; https://www.federalreserve.gov/newsevents/speech/powell20181002a.htm.

© 2019, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.